Optimizing Your Borrowing Potential: Tips for Taking advantage of Finance Opportunities

In navigating the landscape of obtaining prospective, individuals usually discover themselves at a crossroads where the decisions they make might dramatically affect their economic future. The world of lendings can be a complex and often daunting one, with different possibilities presenting themselves in different types. Understanding just how to optimize these opportunities can be the secret to opening economic security and growth - Online payday loans. By carrying out tactical techniques and insightful ideas, customers can place themselves positively to access the funding they require while also maximizing their terms. Everything begins with a thoughtful analysis of one's financial standing and a positive frame of mind in the direction of leveraging financing possibilities.

Evaluating Your Financial Circumstance

Upon beginning on the journey to maximize financing chances, it is important to begin by extensively examining your present financial situation. This proportion is a vital metric that lending institutions think about when establishing your qualification for a funding.

Looking Into Funding Options

To properly navigate the landscape of financing chances, comprehensive study right into various finance alternatives is vital for consumers seeking to make informed monetary choices. Performing extensive study involves discovering the conditions provided by various loan providers, understanding the kinds of lendings offered, and contrasting rate of interest to determine one of the most positive options. By delving into the specifics of each finance item, borrowers can acquire insights right into payment terms, fees, and prospective penalties, allowing them to select a funding that straightens with their monetary objectives.

In addition, consulting with financial advisors or loan police officers can offer personalized advice based on private circumstances. Inevitably, extensive research study empowers debtors to make well-informed decisions when selecting a financing that fits their demands and financial abilities.

Improving Your Credit History

After thoroughly investigating finance choices to make informed monetary choices, debtors can now focus on boosting their credit history to improve their total borrowing capacity. A higher credit report not only boosts see page the likelihood of funding authorization yet also permits borrowers to access finances with better terms and lower rate of interest. To enhance your credit score, begin by getting a duplicate of your credit score record from major credit report bureaus such as Equifax, Experian, and TransUnion. Testimonial the report for any type of errors or inconsistencies that can be negatively impacting your score, and quickly resolve them by contacting the credit report bureaus to correct the mistakes.

Recognizing Car Loan Terms

Understanding financing terms is essential for consumers to make enlightened economic choices and successfully handle their loaning obligations. Some car loans may have early repayment penalties, which customers ought to consider if they prepare to pay off the funding early. By completely comprehending these terms prior to concurring to a financing, customers can make sound monetary decisions and stay clear of possible risks.

Creating a Repayment Plan

Having a clear grasp of financing terms is fundamental for debtors seeking to create a well-structured payment strategy that aligns with their monetary objectives and reduces possible threats. As soon as the financing terms are understood, the next step is to establish a settlement strategy that suits the consumer's financial abilities.

If problems occur in meeting payment obligations, informing the lending institution early on can open up chances for renegotiation or restructuring of the lending terms. Ultimately, a well-balanced repayment strategy is necessary for fulfilling lending commitments properly and maintaining a healthy economic profile.

Conclusion

To conclude, making the most of loaning potential calls for an extensive evaluation of financial status, research study on car loan alternatives, improvement of credit report, understanding of finance terms, and the creation of a structured payment strategy (Online payday loans). By following these steps, individuals can you can try here take advantage of financing opportunities and accomplish their economic goals efficiently

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Brooke Shields Then & Now!

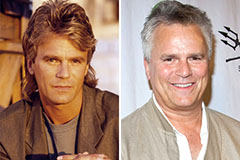

Brooke Shields Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!